What Do Medicare Supplements Cover–The Easy, Non-Corporate Version

So, you may be turning 65, or have noticed that Original Medicare doesn’t cover as much as you thought. Either situation can lead you to wonder, “What do Medicare supplements cover?” Here, you will discover the answer to that question in simple terms.

Part A Coinsurance

All Medicare supplements (or Medigap) cover this benefit. Under Medicare Part A (hospital), you must meet a deductible ($1,288 for 2016) if you are admitted to the hospital. After that, Medicare Part A pays for your hospital stay for up to 60 days. If you are in the hospital for more than 60 days, you then pay a coinsurance of $322 per day up to day 90. Days 91-150, your coinsurance is $644 per day. Days 91-150 are considered lifetime reserve days. This means that these particular 60 days are days that you get once in your lifetime, while the initial 90 reset per benefit period.

All Medicare supplements (or Medigap) cover this benefit. Under Medicare Part A (hospital), you must meet a deductible ($1,288 for 2016) if you are admitted to the hospital. After that, Medicare Part A pays for your hospital stay for up to 60 days. If you are in the hospital for more than 60 days, you then pay a coinsurance of $322 per day up to day 90. Days 91-150, your coinsurance is $644 per day. Days 91-150 are considered lifetime reserve days. This means that these particular 60 days are days that you get once in your lifetime, while the initial 90 reset per benefit period.

The first benefit that a supplement can cover is this coinsurance ($315 per day and $630 per day). Under this benefit, your hospital costs up to an additional 365 days is covered after your Medicare benefits are used up.

All plans have this benefit.

Part B Coinsurance or Co-payment

You will find this benefit in almost all the supplements. Under Medicare Part B (Medical), there is an annual deductible of $166 that must be met. After this, Part B pays 80% of the Medicare-Approved amounts. You are responsible for the remaining 20% (coinsurance).

There are other things that Part B will cover, if they are not covered at 100%, there is usually a coinsurance or copayment (usually a set amount rather than a percentage). Some of these things include:

There are other things that Part B will cover, if they are not covered at 100%, there is usually a coinsurance or copayment (usually a set amount rather than a percentage). Some of these things include:

- Home Health Services (Coinsurance of 20% for durable medical equipment like wheelchairs, hospital beds, etc).

- Most doctor services including therapy, or doctor services while you’re in the hospital (20% again)

- Outpatient Mental Health (20% and maybe coinsurance)

- Outpatient Hospital Services (Guess what? 20%!)

This benefit will cover those co-payments and coinsurance. One thing to keep in mind is that this 80/20 is based on Medicare’s approved amount. For more information, read here (or towards the bottom of this page).

Plans A, B, C, D, F, G, and M cover this at 100%. Plans K, L, and N cover with restrictions or at less than 100%

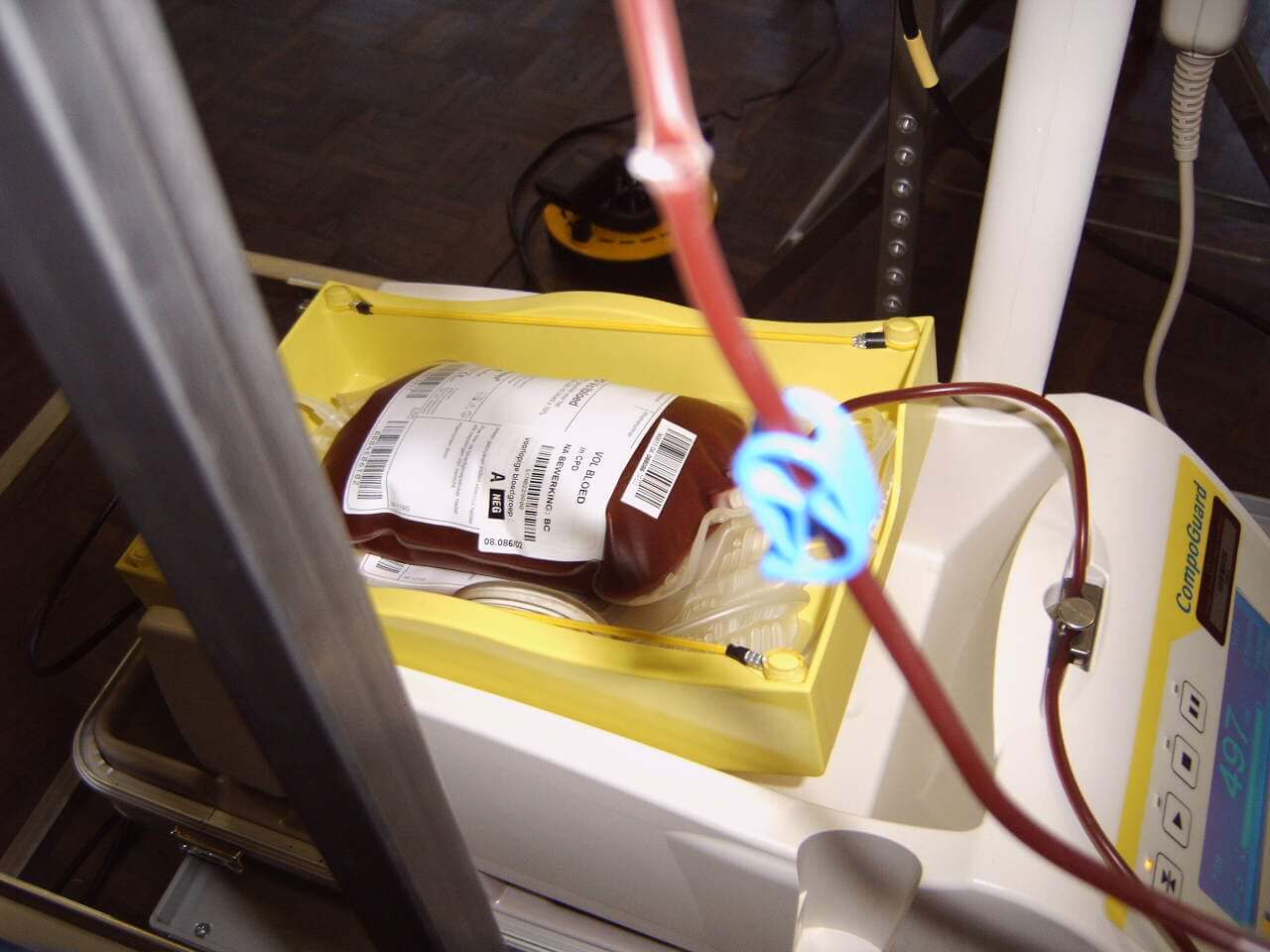

Blood (first 3 pints)

Medicare pays for all blood needed at 100%, but that’s AFTER you cover the cost of the first three pints. In my area, a pint of blood can cost more than $600. If you choose a plan with this benefit, that can save you (in this case) up to $1,800 from your hospital bill if you needed blood. This is a benefit overlooked by those searching, but this can be a rather expensive benefit not to have!

Medicare pays for all blood needed at 100%, but that’s AFTER you cover the cost of the first three pints. In my area, a pint of blood can cost more than $600. If you choose a plan with this benefit, that can save you (in this case) up to $1,800 from your hospital bill if you needed blood. This is a benefit overlooked by those searching, but this can be a rather expensive benefit not to have!

Plans A, B, C, D, F, G, M, and N cover at 100%. Plans K and L cover at 50% and 75%, respectively.

Part A Hospice Care Coinsurance or Copayment

The good news is that Medicare covers hospice care pretty thoroughly. However, there are still a few costs that you are responsible for. For example, if there is a prescription drug needed, you can pay up to $5 per prescription as a co-payment. If you need inpatient respite care, your coinsurance is 5%.

The good news is that Medicare covers hospice care pretty thoroughly. However, there are still a few costs that you are responsible for. For example, if there is a prescription drug needed, you can pay up to $5 per prescription as a co-payment. If you need inpatient respite care, your coinsurance is 5%.

The even better news is that having this particular benefit as part of your Medigap plan will ensure that you don’t have to worry about these costs in the last days–there are lots of other things that need your attention like your family and friends.

Plans A, B, C, D, F, G, M, and N cover at 100%. Plans K and L cover at 50% and 75%, respectively.

Skilled Nursing Facility Care Coinsurance

Now, on this topic, there can be some confusion between skilled nursing, nursing home, and custodial care. This is not a long-term care benefit. For that you would need a long-term care policy, or some type of financial vehicle large enough to absorb the cost.

What this refers to is a facility designed for short-term (in my language–less than a year). For this benefit, you would have to have stayed in the hospital at least 3 consecutive days and, following your stay, require monitoring 7 days per week or skilled therapy at least 5 days per week. Medicare Part A pays for the first 20 days. After that, (Days 21-100) you have a co-payment of $161 per day. The Skilled Nursing Facility Care benefit covers that $161. Note that after day 100, You are responsible for 100% (this is where Long Term Care would kick in).

Plans C, D, F, G, M, and N cover at 100%. Plans K and L cover at 50% and 75%, respectively. Plans A and B do NOT cover this.

Part A Deductible

The key thing about the Prat A Deductible to remember is that this is a benefit period deductible. Simply put, (of course there are more details), if you are admitted to the hospital for problem A, you are subject to the deductible of $1,288. If, three months later, you are then admitted for problem B (or problem A again since it has been more than 60 days), you are subject to another $1,288 deductible. This can happen up to 5 times per year if you are having a really bad year.

Supplements with this benefit will pick up that $1,288 deductible each time it is due!

Plans B, C, D, F, G, M, and N cover at 100%. Plans K, L, and M cover at 50%, 75%, and 50% respectively. Plan A does NOT cover this.

Part B Deductible

While the Part A deductible is per benefit period, the Part B deductible is annual. The amount of this deductible in 2016 is $166. Any supplement with this benefit will cover this $166 each year.

Plans C and F cover at 100%. A, B, D, G, K, L, M, and N do NOT cover this.

Part B Excess Charges

from the Part B Page

A word about 80/20. There is a thing called “accepting assignment” that doctors have the right to do or not do. When a doctor accepts assignment, he or she basically agrees to charge what Medicare says is acceptable. If a doctor doesn’t accept assignment, Medicare will still use the Medicare assignment amount to base their 80% on. The doctor then has the right to charge an additional 15%. This 15% is called the excess charge. Here’s a scenario:

You go to the doctor for a checkup and his or her charge is $200. Medicare’s assignment is $100 (meaning that that’s what Medicare will base their payment on). The doctor accepts Medicare’s assignment and amends the charge to $100. Medicare Part B will pay $80, and you’re responsible for $20.

Or, take that same checkup at $200. Medicare’s assignment is $100. But instead of accepting Medicare’s assignment, the doctor chooses not to. The doctor can then charge an additional 15% over Medicare’s assignment. The good news is that the Medicare approved amount for these non-participating providers is actually 95% of their assignment, so in this case, $95 (making the 15% $14.25). Medicare will still pay $76 (80% of $95), and you’re responsible for the $19 PLUS the extra $14.25 making it a total of $33.25 instead of just $20. Of course you can add a zero to all the numbers and see that the result could be an extra $142.50 on top of the $190.

I say all that to say this: if you have this benefit in your supplement, you don’t have to worry whether or not the doctor accepts Medicare’s assignment. This is actually pretty huge!

Plans F and G cover at 100%. Plans A, B, C, D, K, L, M, and N do NOT cover this.

Foreign Travel Exchange

If you, like me, would LOVE to travel all over the world when you retire, there may be an instance where you ave a medically necessary emergency. There’s no way an ambulance is going to transport you to the states just to be seen. After you meet a $250 annual deductible, plans with this benefit will pay a percentage of the cost (up to a lifetime limit of $50,000.

If you, like me, would LOVE to travel all over the world when you retire, there may be an instance where you ave a medically necessary emergency. There’s no way an ambulance is going to transport you to the states just to be seen. After you meet a $250 annual deductible, plans with this benefit will pay a percentage of the cost (up to a lifetime limit of $50,000.

Plans C, D, F, G, M, and N cover at 80%. Plans A, B, K, and L do NOT cover this.

Out-of-Pocket Limit:

Plans K and L feature out-of-pocket limits of $4,960 and $2,480. This means that once you meet the $166 Part B deductible and then spend up to those amounts for medical bills, the Medigap plan will pay for everything else at 100% for the rest of the year. Only these two plans have that feature.

Is that all there is?

Yes and no. All companies that cover these plans have to cover what has been explained above. This is where they are considered “standardized.” However, not all companies present the Plan F (for example) with the same pricing, added benefits, or riders. For more information on this, please read up on this page.

What other questions do you have about what Medicare Supplements cover? Please leave your comment below.

https://simpleseniorhealth.com/what-do-medicare-supplements-cover-the-easy-non-corporate-versionWhat Do Medicare Supplements Cover--The Easy, Non-Corporate VersionMedicare SupplementsSo, you may be turning 65, or have noticed that Original Medicare doesn't cover as much as you thought. Either situation can lead you to wonder, 'What do Medicare supplements cover?' Here, you will discover the answer to that question in simple terms. Part A Coinsurance All Medicare supplements (or Medigap)...Raphael raphaelstarr@gmail.comAdministratorRaphael resides north of Indianapolis, Indiana. He is an independent insurance agent. He is also the worship leader at his church, a husband, and step-father of one awesome 15-year-old girl. You can contact him at raphael@simpleseniorhealth.com.Simple Senior Health

I’m not a senior yet, but wow. You covered pretty much all the questions about Medicare. I do have a question, can a person get private insurance and have medicare at the same time, to cover expenses that Medicare doesn’t cover? Thanks for all the great information. 🙂

You can, Evelyn. Some use private insurance, or even retired group insurance while continuing to have either A alone, or A and B together. If that happens, one will be primary and the other will be secondary. Medicare likes to be primary in some situations and secondary in others. I think I will go further into this on a future post. One important thing to note is that you cannot have anything from the marketplace (Affordable Care Act or Obamacare) if you are also on Medicare.

This is great info. Much of it seems to apply to my homestate of Washington as well. Is there anything specific I should know that is only for Indiana?

Nothing of this is just Indiana. This is a broad national list. Things don’t start getting state-specific until you look into the Medigap companies that do business in each state. Thanks for the question!

Hi Raphael,

That’s real good information for us seniors. It’s good that someone is thinking about us. Can you broaden your scope and cover the other states as well? Cheers.

I’m always thinking about seniors! There are so many turning 65 this year that I know lots of people need the information in a way they can understand it (not that other sites don’t do that). The scope on this page is national. However there are some things that I narrow down to Indiana, such as when I talk about the different Medicare Supplements and how the companies structure their rates. I can start to link other states in the near future. What state are you thinking about in particular?

Hi Raphael, this is incredible. I live in the UK and there is talk of our national health service going private, and I wanted a rough idea of how much extra we’d have to personally fork out in insurance and payment plans. Thanks for this detailed breakdown of where the costs come from

No problem, Hassan. I didn’t know about the talk of future private health service in your country. That should be interesting. I hope that it continues to be a good service though!

Great tips. Are these applicable outside of where you live??

Great question, Steve. The information posted here is national information. I’ve thought about changing my tagline to not use the word “Indiana” in it. I’m actually licensed in Indiana and Michigan. Other specific things, such as on the linked page about standardization, I’m just more familiar with Indiana. I hope to find other states as well when I have the time (that’s a lot of research)!

Hi

This article is very helpful and interesting.

Thank you very much

No problem, Daniella! I hope to have even more answers to common questions in the near future!